A satisfied customer is our best business strategy

Sharp was fantastic to work with, and they do quality work. We were in a tight time crunch to get a 409A done in preparation for an M&A event, and Sharp worked through the weekend to help us meet our timelines. I would recommend them to anyone, and will absolutely use them moving forward.

It was great working with Sharp 409A. They worked very fast and accurately. If you are looking for a service to provide a hassle free 409a evaluation, it’s pretty much impossible to beat Sharp 409A’s quality and price.

Sharp 409A went above and beyond for two important valuations we needed to perform for our audit. They made sure to understand our business and equity structure, and worked diligently with us and our auditors in order to meet a tight deadline. I highly recommend their work.

We are very pleased with your level of professionalism and the final report thank you very much it was nice to work with you!

Recently I’ve had the pleasure to work with Rajarshi on our company valuation exercise. Not only did he keep the promised timelines for deliverables, he also was extremely patient when the original scope of work slightly had to be altered. He went above and beyond to complete the tasks that were slightly out of the scope. He brought along good expertise that involved 409A guidelines and we appreciate his contribution very much. If anyone is looking to hire a 409A valuation expert, I highly recommend working with Rajarshi/his firm.

Our Pricing

Find out all the required informaion about 409A Valuation Cost and the process followed by Sharp 409A

PRICING

- This comprises a thorough 409A Report that will be signed by a qualified industry expert possessing the best of certifications.*We provide full Audit Support to our clients. Our audit-support services will attract an additional fee at the rate of $150 per hour.

TURNAROUND TIME

- We provide the first draft report within two working days (instead of weeks) of receiving all the required details to perform the analysis.

Documents needed to perform the valuation

From the Lawyer or Cap-table firm

From the Auditor or Accountant

From the Company

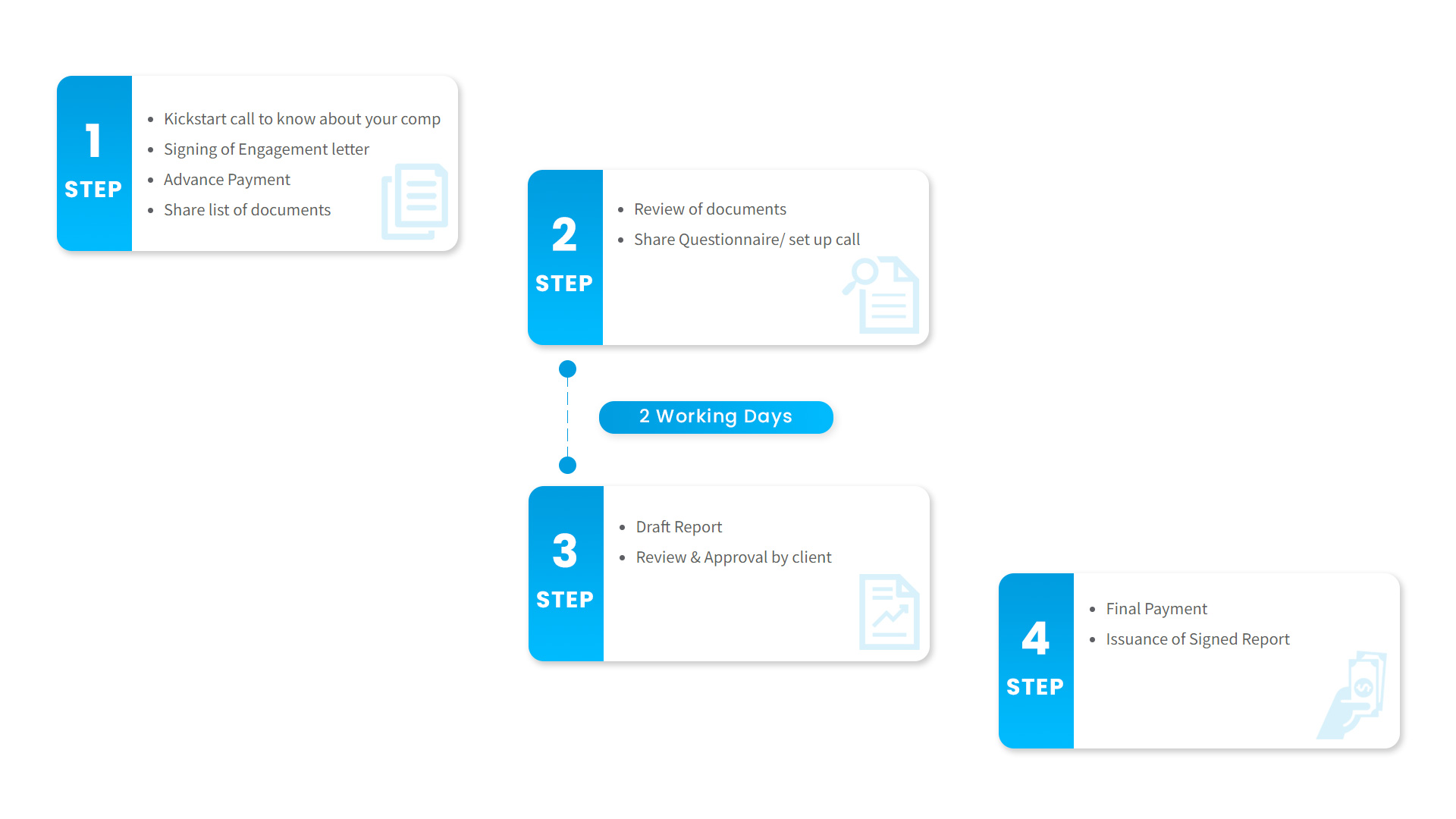

409A Valuation Process

Detailed Information On Process Followed for 409A Valuation

If you want an accurate 409A valuation process, the time taken to complete 409A valuation ranges drastically from days to months. Most of the time it relies on the demand of the client and the situation. It is necessary to understand the complete 409A Valuation Process cycle and the time needed for every step.

Step 1 of 409A Valuation Process

Kickstart Call to Know About Company

To begin, start by determining if the 409A valuation is the correct thing for the organization before going through the valuation process, Also we need a proper valuation date. Collaborate with a qualified and independent valuation provider. It’s necessary to use a company with expertise in valuing private companies and a performance track record of 409A valuations.

The valuation firm will request financial information for the company that includes projections and other relevant data. They may also interview key employees to understand the company’s business model and growth prospects.The valuation firm should not have any difficulty of interest with the company or its stakeholders.

Signing of Engagement letter

Often, it takes approximately a day to a week for this to happen. Once the terms are agreed upon. The 409A valuation provider sends over the engagement letter to sign. Also, instant payment through Stripe is accepted to wire the payment.

Advance Payment

Expenses during the course of the valuation, such as travel expenses, data acquisition costs, legal fees, and other out-of-pocket expenses advance payment are required to cover these costs. Understand the payment structure, including any advance payment requirements, and that you have a clear understanding of what expenses are covered. Moreover, keep correct records of all payments and expenses related to the 409A valuation for compliance and target reporting.

Share a list of documents

Now in the next step, the Valution provider typically requests specific documents and information from the company being valued to accurately determine the fair market value (FMV) of the firm’s common stock. 409A Valuation Process clients are able to securely fill in their information and necessary documentation through the help of Sharp 409A. But, in some situations where firms need to draft their financial projections for five years, it takes time.

- Financial Statements

- Projections and Business Plan

- Capitalization Table

- Stock Option Plan

- Recent financing Rounds

- Contracts and Agreement

- Intellectual Property Information

- Corporate Governance Documents

- Customer Contracts and Revenue Data

- Market and Industry Data

- Historical Stock Option Grants

- Employee Information

- Recent M&A or Investment Activity

- Valuation Methodology and Assumptions

- Tax Status and Compliance

- Other Relevant Information

Step 2 in Valuation Process

Review of documents

Review the documents counted as critical 409A Valuation Process in several contexts, including legal, business, financial, and personal. Companies also take time to review the documents and assemble the financial statements year to date in cases where the valuation date freshly passed. So depending on the situation, clients might finish it in an hour or several weeks. The aim of document review is to examine and assess the content, relevance, accuracy, and compliance of documents.

Share Questionnaire\set up call

409A Valuation Process involves proper information about your company and its equity, which is widely used to determine the fair market value of your common stocks and includes general company information, ownership and capitalization, recent financing rounds, finance information, stock option plans, and much more. 409A valuation provides a discussion of the details and requirements of valuation.

Step 3 Followed in 409A Valuation

Draft Report

The draft valuation report takes about two, to three weeks to complete. Sometimes for a smooth valuation process, it requires more accurate data and documents and this takes additional time. In some cases where the company demands a fast turnaround, it may be done faster, but it has an additional price. While it is a difficult process but still possible for those clients who want their process as soon as possible.

Review & Approval by Client

The clients are offered the opportunity to examine the draft report before they get the final certified report. Then meet for a discussion about the assumptions and inputs for the 409A valuation process to ensure we define the company correctly. If any changes require to be done, this adds a few days to fully depending on the scenario.

Step 4 – Final Step in Valuation Process

Final Payment

409A valuation process does involve payments for the valuation process does involve payments for 409A valuation service. Final payment is provided when the process ends. It’s an ongoing compliance requirement for the company with periodic updates and employee notification as necessary to maintain tax compliance.

Issuance of signed report

A representation letter is requested from the company once the draft valuation is agreed upon with the organization’s management. After receiving the signed letter, the final valuation is delivered to the client.

409A Valuations for Startups

You will need a 409A valuation, if you issue or plan to issue ESOPs for the U.S. employees. Sharp 409A has valued more than twenty billion dollars net-worth of company assets. Having such vast experience, our experts have performed valuations for companies with different legal structures e.g S-Corp, C-Corp, LLC, etc. Our team knows the nuances of each of these legal structures and therefore can perform the valuations efficiently.

Moreover, our team of analysts have performed 409A valuations for companies residing in different geographies across the globe. If you are a non-US company & planning to issue options to your employees who are US citizens then your company needs to follow IRC 409A regulations. Sharp 409A has performed several valuations for companies based out of Europe and Asia.

Whether you are a company less than a year old or a late-stage company – having raised several rounds of funding – we cater to 409A valuation needs of all such companies. We have extensive experience in dealing with all stages of companies. Backed by our team of experts & our highly automated systems, we can cut through any complexity within the cap table with ease and agility.

409A valuation from Experts

Sharp 409A experts have more than a decade of experience and will help you determine a fair market value of your company. Many of the low-cost players in the industry tend to overvalue the shares to minimize the compliance risk. Our expertise in start-up valuations will ensure that your business is priced fairly and is audit defensible. We therefore provide full audit support to our clients and our reports have passed the audits of even Big Four audit firms and other auditors.

It is vital to look for a valuation firm that has experience and familiarity with your industry and your unique funding situation. Our experts have experience and familiarity with various industries. These include industries like emerging technology, clean energy, education, life-sciences, medical devices, etc. Moreover, we have worked for startups of various stages in their life-cycle i.e. from startup to an IPO. Our experts are qualified professionals who meet the IRC 409A regulations. They are finance professionals who have world class credentials such as CFA. They have worked for leading 409A valuation providers.

Comprehensive and Audit-Ready Reports

Sharp 409A provides a very detailed analysis of a firm. It’s in-depth 60+ pages report has all the details required to make it audit defensible. It includes an overview of the company, industry and the economy. Apart from this, it also discusses in detail the methodology used to arrive at the fair market value of the firm. The report is reviewed and signed by a certified professional such as a CFA charter holder.

The reports strictly follow the AICPA guidelines. We ensure that our reports are of high quality and meet the requirements of the Safe Harbor standard of the IRS.

Please refer to this to know more.

Helping Founders

Getting a 409A valuation is important for startups issuing shares in their company

Frequently Asked Questions

Let’s Connect

Please fill in the form below and we will get back to you asap.